are inherited annuities tax free

One way to spread out the tax impact of an annuity death benefit is to. Basically your first withdrawal is front loaded with all the gains and interest youve accumulated in your account.

Annuity Beneficiaries Inheriting An Annuity At Death 2022

An annuity is a financial product that can be passed down from one generation to another.

. Does a Beneficiary Pay Inheritance Tax on an Annuity. Either way you will pay regular taxes only on the interest not the principle. Over 20 years you earn an additional 30000 through interest and earnings.

August 30 2021. You can take the entire value of the annuity as a lump sum or set up an inherited IRA to receive the money. The earnings are taxable over the life of the payments.

Can Annuities Be Inherited. Qualified annuities are funded with pre-tax. Call for free case evaluation.

If youre not the spouse of the deceased you basically have two options for taking distributions. If you are on the receiving end of an inherited annuity it could turn out to be a double-edged sword. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account balance.

While an inherited annuity can provide an unexpected windfall the tax implications of withdrawing money from it could be costly. Although you cant completely avoid taxes on annuity payouts by understanding how an annuity is structured and. Unlike some investments annuities do not receive a stepped-up basis at death and so the tax consequences can be severe.

Annuities offer enhanced death benefits to allow beneficiaries to offset taxes or spread the tax burden over time. Once the annuity enters the annuitization phase they must begin paying taxes on earnings as well as any other untaxed portions. Inheriting a TSA.

Ad Annuities are often complex retirement investment products. Life insurance will also allow the conversion of a tax-deferred status to tax-free status while a policy owner is alive. These payments are not tax-free however.

Your first payment may be fully taxable as income. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Learn some startling facts.

If you inherit an annuity you may have to pay taxes on your money. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Call for free estate planning evaluation.

Each week Zacks e. However the taxed amount will vary on factors like the payout. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Because the money you use to fund the annuity has already been taxed you can withdraw your principal tax-free early withdrawals may be subject to the IRS penalty tax andor surrender charges. Ad Trust Planning ensures you do not lose what youve earned. How To Pass Money To Heirs Tax-Free.

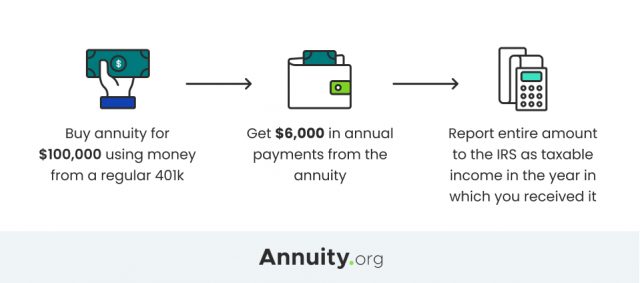

For example imagine you purchase a deferred annuity for 100000. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is taxed. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed.

These payments are not tax-free however. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is taxed. Depending on the type of annuity the tax will have to be paid on the lump.

An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. All 20000 withdrawn from the annuity will appear on your tax return as ordinary income. When a person inherits an annuity the gains stay with the policy.

At that point you have a 180000 account of. If you do not like the features of an annuity you can trade it for one that offers better features or pays a higher yield. The insurance company.

If you keep the annuity you will usually have to. You may also have to pay fees to cash out the annuity. However any earnings inside of the annuity contract will be taxed when theyre withdrawn.

Principal that was not taxed and earnings will be subject to taxation as income. To avoid taxes on inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy. These annuity payments are taxed at your regular tax rate and can be sold wholly or in part for cash-in-hand.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. A 1035 exchange allows nonqualified annuities to be exchanged for another nonqualified annuity tax-free. Most likely the entire amount of any tax-sheltered annuity TSA you inherit will be taxable.

What youll pay in taxes for an inherited annuity can depend on whether the annuity is qualified or non-qualified. Taxes are imposed on inherited annuity earnings. Ad Learn More about How Annuities Work from Fidelity.

How To Avoid Paying Taxes On An Inherited Annuity

Annuity Tax Consequences Taxes And Selling Annuity Settlements

How Are Inherited Annuities Taxed Annuity Com

How To Avoid Paying Taxes On Annuities Valuewalk

How Are Annuities Taxed For Retirement The Annuity Expert

Annuity Taxation How Various Annuities Are Taxed

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Commonly Asked Questions

Qualified Vs Non Qualified Annuities Taxation And Distribution

Own An Inherited Annuity Stretch Your Assets With A Low Cost Tax Efficient Option Kiplinger

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts

Annuity Beneficiaries Inherited Annuities Death

Annuity Beneficiaries Inheriting An Annuity After Death